By Rob Handfield

As vaccination rates in the US, the UK, and Europe have risen, economies have shifted back and capital projects are beginning to resume. However, significant problems remain with respect to major shortages that exist in supply chains.

- Consumers are finding that everything from appliance parts, bicycles, and other products is in short supply. Post-pandemic spending is booming, but consumers are discovering empty shelves in many retails for goods they’ve come to expect are readily available. The latest CPI increase reflects a 5% increase from a year ago, the highest annual inflation rate in 13 years.

- Demand for labor is rising, but many jobs remain vacant, with a shortage of qualified applicants causing many companies to complain about ongoing federal COVID relief checks, and impacting state unemployment rolls.

- Demand for agricultural commodities such as soy oil is reaching record highs, causing prices to spike for many goods including hobs, gasoline, diesel, crude oil, corn, copper, coffee, and others. Grocery manufacturers are seeing shortages and price hikes on wheat, corn, and many other commodities.

- Rubber shortages will occur likely as a result of poor harvests, Chinese investor futures cornering the market, and a lack of investment on the part of Singapore bankers.

- Increased steel prices have added an average of $515 to the cost of an average US light vehicle, as has the cost of aluminum used in production products.

- Chinese operators are in some cases increased prices or halting operations, and are in some cases refusing additional orders due to capacity limitations due to higher raw material costs. However, ports have started moving again as of June 14, 2021.

- Lumber prices have escalated, as lumber mills grew capacity by 10% but have failed to keep up with housing market growth. Some of this growth has also been driven by increased investment in blocks of single-family homes by financial investors like BlackRock.

- Semiconductor lead times have gone from several weeks to six months or more; automotive companies have been shut down due to a lack of chips.

The combination of many different factors contributed to depleted inventory positions across the supply chain, a condition that remained evident through the retailers’ fiscal year ended January. The latest quarterly reports from retailers appear to show progress in rebuilding merchandise levels even as manufacturing has been disrupted, freight is still delayed at the ports and transportation capacity remains historically constrained.

The increase also comes as several companies have accelerated inventory turns, the benefit of supply chain initiatives implemented prior to COVID and then greatly advanced after the pandemic began, which presents a headwind to building stock levels. However, the recent improvement on the inventory front is compared to the period that included the onset of the pandemic and a run on inventory, which was sudden and led to widespread stock-outs on several household merchandise SKUs. But many problems are also due ot the situation at ports.

Port Problems

For the first time in the rail container volume index history, nonholiday empty containers outnumber the loaded container volumes heading into Los Angeles. This occurred briefly at the beginning of 2019 around New Year’s when the trade war with China was escalating. Empty international containers are controlled mainly by the maritime operators and can signal growth in import volumes. This one, however, may just illustrate how dire the situation really is.

Knowing who controls the containers is the key to understanding what to make of their movement patterns. The international container flow is governed by shipping operators and people who deal with international trade orders. They need to position the containers in places where they can be filled. In this case, most of that is across the Pacific Ocean in China and other Asian countries.

The port conglomerate of Los Angeles and Long Beach is the primary gateway between Asia and the U.S. and has been a bellwether for freight pattern shifts over the past two to three years — basically the main convergence zone of freight in the U.S. Increased durable goods demand has exacerbated the trade imbalance between the U.S. and China and caused shipping rates to hit record levels moving across the Pacific. This has also led to maritime operators neglecting U.S. exporters by moving empty containers back to Asia without cargo in order to take advantage of the pricier and more lucrative freight moving east.

Moving international containers domestically can be tricky as most of the equipment is set up to handle the domestic trailer sizes. This makes it cumbersome for the international community to get the empty containers where they need to be for U.S.-based pickups. It is far more economical just to move it by rail back to the port and ship it back to China when rates are this high. What is more concerning is that this may not be the worst of it from a cost and supply chain bottleneck perspective. Maritime Market Expert Henry Byers has this to say about the surge of empties and what it signals for shippers and transportation providers moving forward:

“It’s time to sound the alarms. The shortage of container capacity is already affecting many supply chains, but almost no company will be spared from what lies ahead. The congestion and delays happening right now are primarily part of the downstream ripple effect that was largely caused by last year’s increased import volumes. Since we are able to see these volumes as they are leaving on vessels that are destined for the U.S., we can tell you that these TEU volumes are still hitting record highs. So, if the downstream supply chain is already under enormous pressure, we are likely to see rates reach new heights as well.”

Just last month Hapag-Lloyd said it had ordered 150,000 TEUs of standard and refrigerated containers from a Chinese manufacturer to be delivered this year. The majority of the containers are expected to be delivered in the third quarter.

CEO Rolf Habben Jansen was quoted in Wednesday’s announcement as saying that “demand continues to be very high and the supply of container equipment is currently one of our industry’s biggest challenges and demands our full attention. To counteract the container shortage — but most importantly to offer our customers a better service — we have repeatedly invested in our container fleet since the beginning of the pandemic.”

Lack of containers and slow turn times are particularly apparent during U.S. import surges. That shortage becomes much more than a blip on a FreightWaves SONAR chart when the import surge is as long-lasting as the one U.S. ports have been experiencing since Chinese factories reopened after COVID-19-forced lockdowns last year and U.S. consumers turned to e-commerce in droves.

COVID outbreaks in China have also been causing havoc at major ports. At Yantian, a container port in the southern Chinese city of Shenzhen, an outbreak among dockworkers has brought traffic to a virtual standstill, putting more strain on an international shipping industry that has struggled with a persistent shortage of empty containers and a weeklong blockage in the Suez Canal earlier this year.

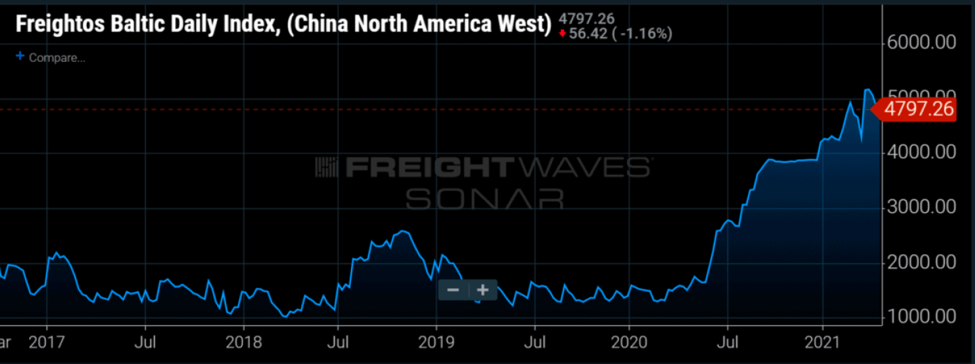

Some ships have had to wait up to two weeks to take on cargo at Yantian, with roughly 160,000 containers waiting to be loaded, according to brokers. The price of shipping a 40-foot container to the West Coast of the U.S. has jumped to $6,341, according to the Freightos Baltic Index—up 63% since the start of the year and more than three times the price a year earlier.

Activity at the port, which handles more than 13 million containers a year, is now at 30% of normal levels and the delays could persist for several weeks, says Hua Joo Tan, a Singapore-based analyst at Liner Research Services. Lars Mikael Jensen, head of network for A.P. Moller-Maersk A/S, the Danish shipping giant, said the backlog in Shenzhen would be felt globally, affecting goods sold at Walmart Inc. and Home Depot Inc., companies that have established logistics bases around the port.

“It’s a huge and very active port and when you get delayed there, it has ripple effects on supply chains across the world,” said Jensen, whose firm is diverting 40 container ships from Yantian to other ports, including Hong Kong. The blockage of the Suez Canal lasted a week and it took 10 days to clear the backlog, he said.

“Here there is no end in sight. The Chinese will keep everything closed until they are certain Covid won’t spread,” said Jensen.

U.S. ports’ exports of empty containers have skyrocketed as part of an industry effort to get boxes back to Asia as quickly as possible to be refilled and shipped out again. At the Port of New York and New Jersey, for example, the number of exported empties in March leapt 77.5% year-over-year.

The traditional peak season for maritime shipping is in August and September. Rail and intermodal typically follow, then trucking. The market has been plateauing from a volume and rate perspective on all three modes since late February. The data suggests there is a good chance the transportation situation gets worse before it gets better. The Baltic Dry Index is at an incredibly high level and is indicative of severe capacity shortages in ocean freight channels.

- Categories:

- Series: