Free Tax Return Assistance Available for 2017 Tax Season

About 20 accounting students in the NC State University Poole College of Management are providing free assistance with income tax preparation for the 2017 income tax return season. The service is available for those whose income did not exceed $64,000 in 2016.

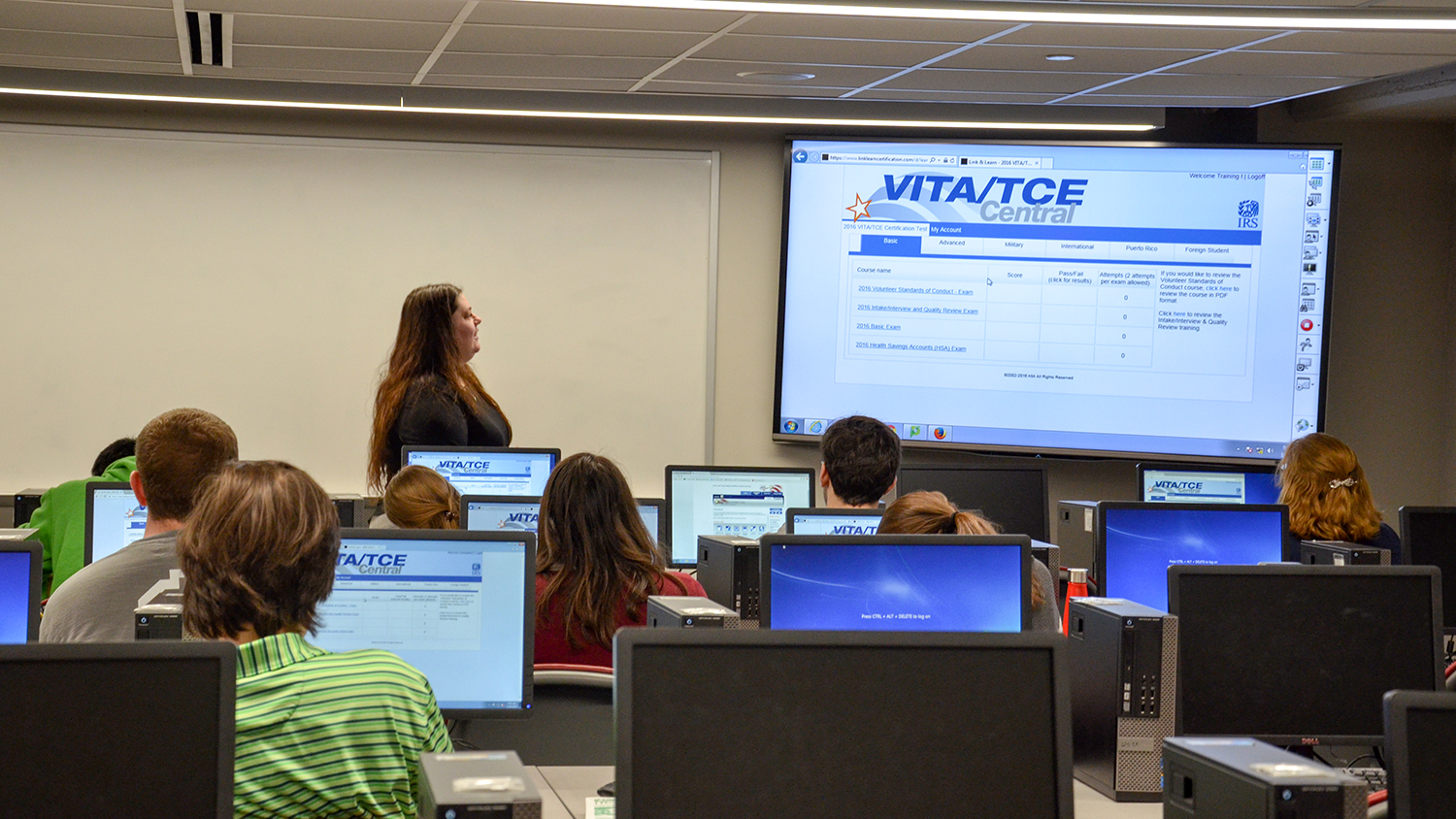

The student volunteers completed a training session on January 28, enabling them to help others complete their income tax returns using the MyFreeTaxes online system. This program is made available through the IRS-certified Volunteer Income Tax Assistance (VITA) program, a partnership between United Way and H&R Block.

The student team will not be able to prepare 1040NR returns. Non-resident alien students can visit NC State’s Office of International Services for more information on how to file taxes.

The income tax return help sessions will be held on the NC State University campus in room B400 Nelson Hall, from 9:00 a.m. to 1:00 p.m. on the following Saturdays:

- February 11

- February 25

- March 18

- April 8

Nelson Hall is located at 2801 Founders Drive in Raleigh, N.C. That is at the corner of Hillsborough Street and Dan Allen Drive. Those using this free service should enter Nelson Hall from the campus side (southwest corner) of the building. A sign will mark the entrance to the stairwell going to Room B400. No appointments are required or allowed, as service is provided on a first-come, first-served basis. People will be asked to check in when they arrive. For assistance with ADA accommodations, contact NC State’s Office of Equal Opportunity and Equity at 919-513-0574 or by email at equalopportunity@ncsu.edu.

What to bring

Following are documents that participants must bring with them when coming to the tax return help session. To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

- Proof of identification (photo ID)

- Social Security cards for you, your spouse and dependents

- An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have

- Social Security number

- Proof of foreign status, if applying for an Individual Tax Identification Number (ITIN)

- Birth dates for you, your spouse and dependents on the tax return

- Wage and earning statements (Forms W-2, W-2G, 1099-R,1099-Misc) from all employers

- Interest and dividend statements from banks (Forms 1099)

- All Forms 1095, Health Insurance Statements

- Health Insurance Exemption Certificate, if received

- A copy of last year’s federal and state returns, if available

- Proof of bank account routing and account numbers for direct deposit such as a blank check

- Total paid for daycare provider and the daycare provider’s tax identifying number such as their Social Security number or business Employer Identification Number

- Forms 1095-A, B or C, Affordable Health Care Statements

- Copies of income transcripts from IRS and state, if applicable

- Form 1098-T for scholarship and education tax benefits

- University statements including tuition paid for the year, scholarships received and receipts for books and other required educational expenses.