Filtered Results

Tax Havens Can Have Hidden Costs for Corporations

Are the Ultra-Wealthy Avoiding Income Taxes?

Is the ‘Apple’ juice worth the squeeze?

Having Employees Overseas Helps Companies Reap U.S. Tax Benefits

Insights and Trends – Keeping Up With the Accounting Profession

Why Did Some State Tax Revenues Increase During the Pandemic?

Biden Announces A New Round of COVID-19 Stimulus Payments

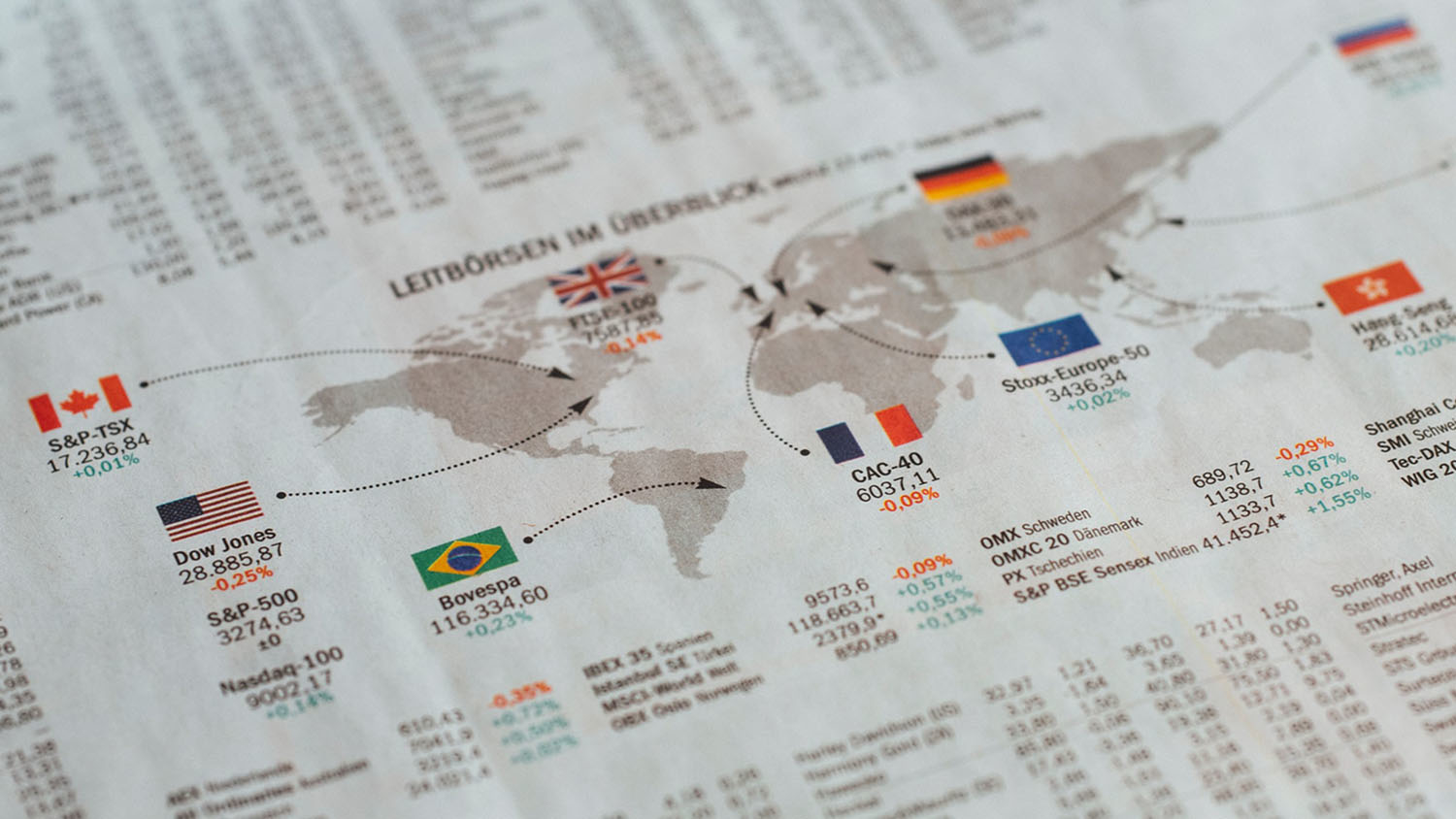

Poole Podcast Episode 2: U.S. Taxation in a Global Economy

Keeping Accounting Accountable—A Q&A with Eileen Taylor and Paul Williams