Goldman

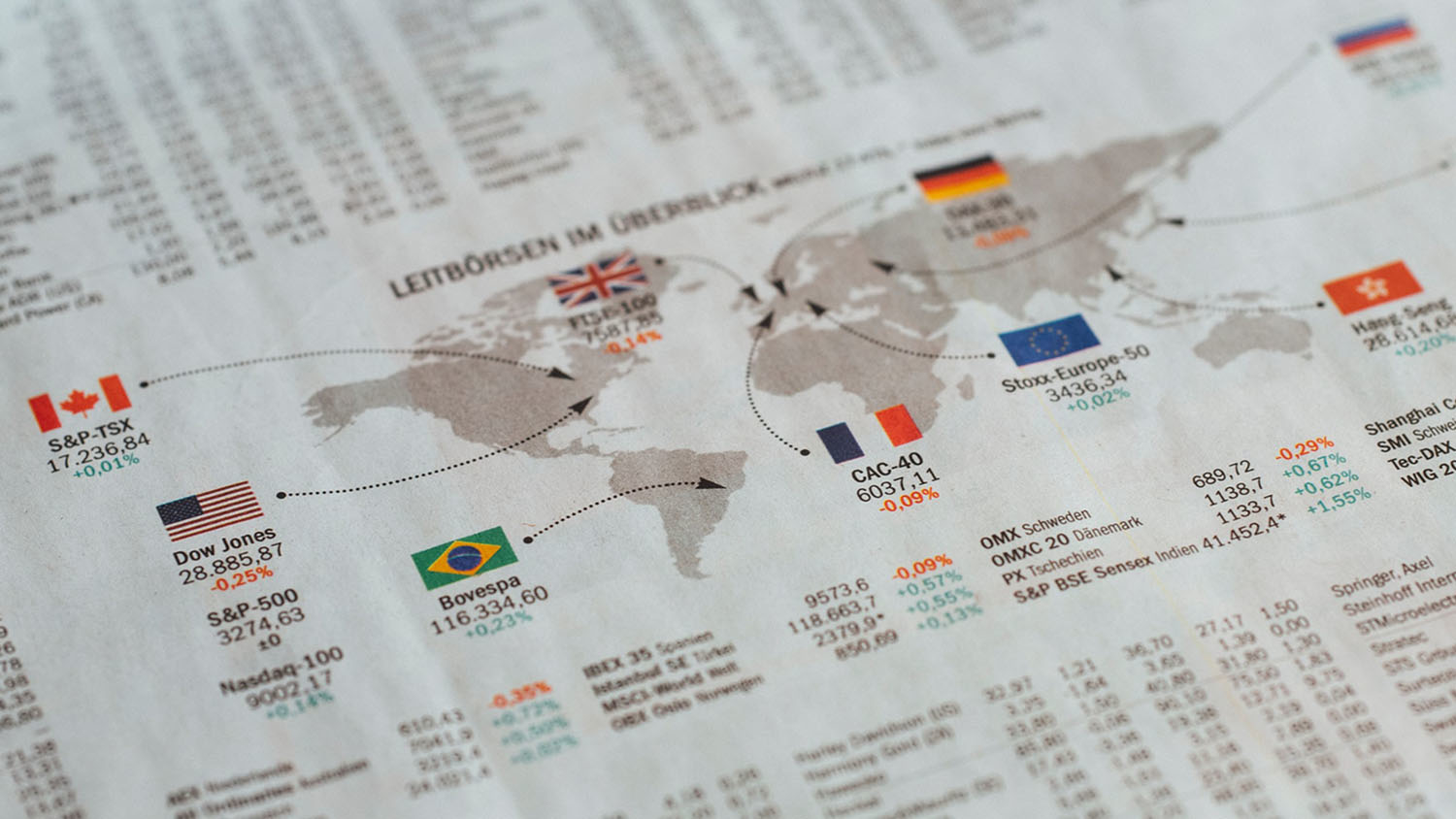

Having Employees Overseas Helps Companies Reap U.S. Tax Benefits

Why Did Some State Tax Revenues Increase During the Pandemic?

Biden Announces A New Round of COVID-19 Stimulus Payments

Poole Podcast Episode 2: U.S. Taxation in a Global Economy

Behind Bitcoin – A Closer Look at the Tax Implications of Cryptocurrency

Robinhood and the Rise of Day Trading: What does it mean on your income taxes?

Taxation and Representation: How a Biden Presidency Could Affect Federal Income Taxes

Having Clients From Many Industries Can Hurt the Effectiveness of Auditing Firms

When Board Members Get Involved, Corporate Tax Burden Goes Down